Diminishing value depreciation rate

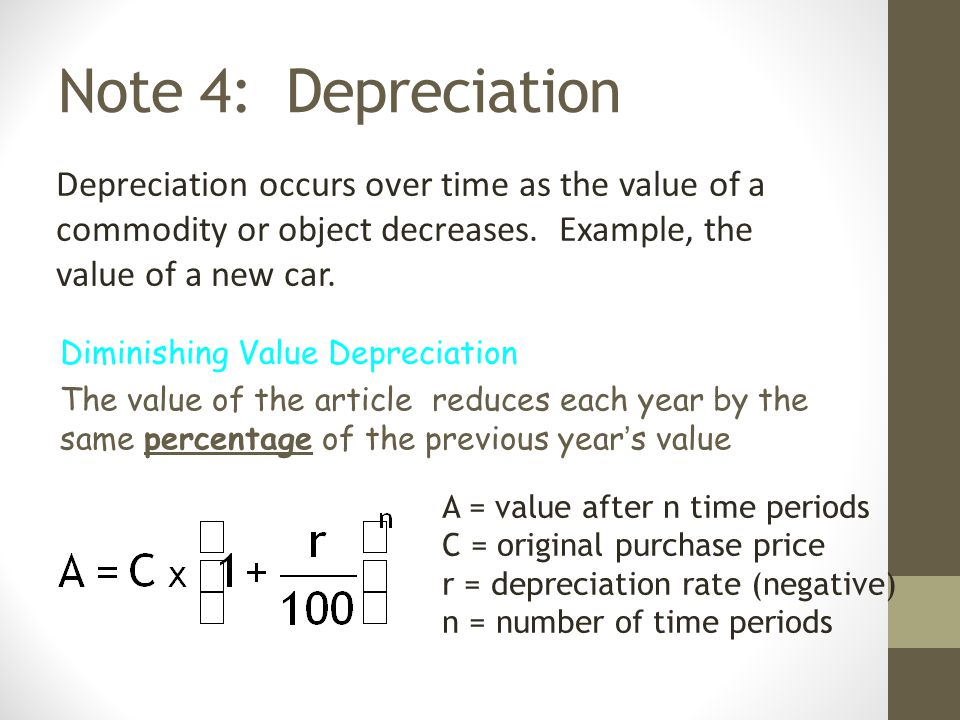

The diminishing balance method also known as the reducing balance method is a method of calculating depreciation at a certain percentage each year on the balance of the asset which is. The rate of depreciation is applied to the diminishing value of the asset.

Note 4 Depreciation Depreciation Occurs Over Time As The Value Of A Commodity Or Object Decreases Example The Value Of A New Car Diminishing Value Ppt Video Online Download

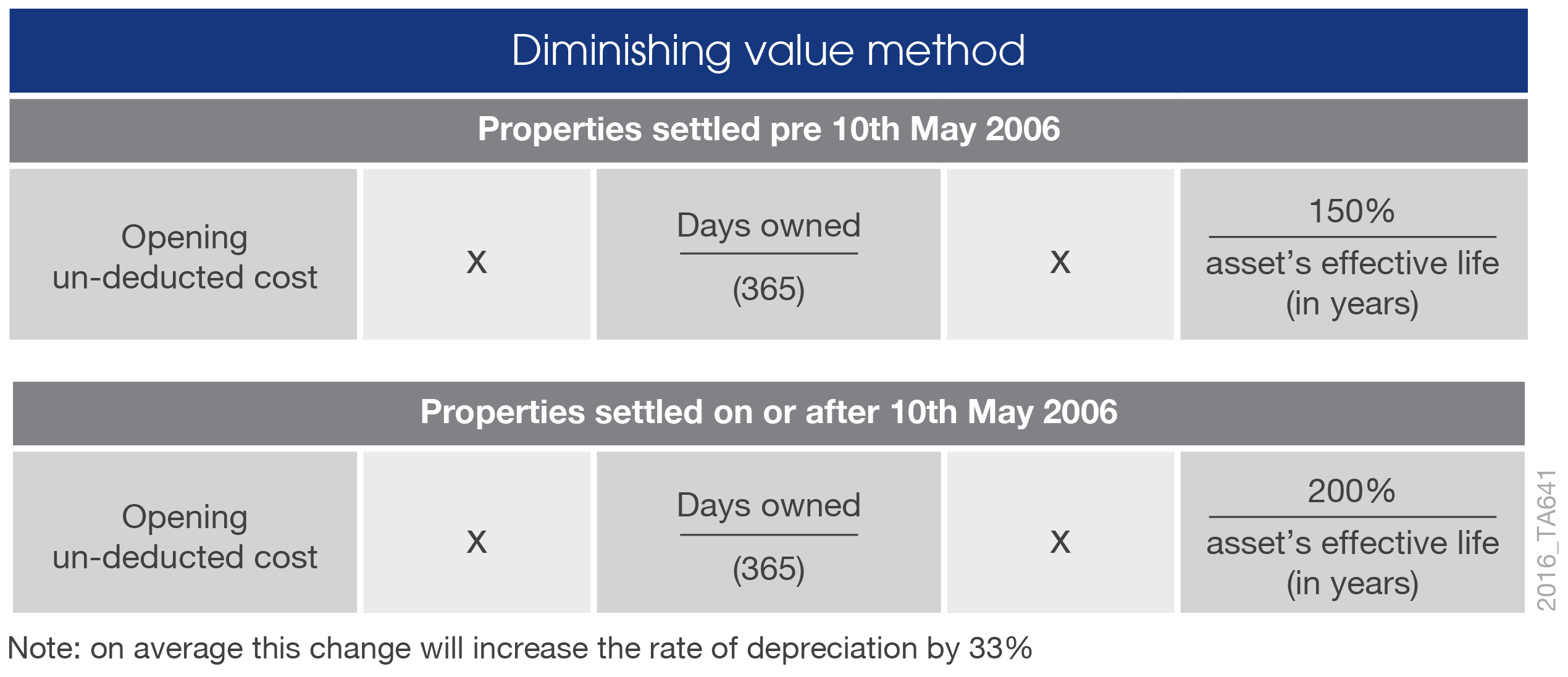

Depreciation rates are based on the effective life of an asset unless a write-off rate is prescribed for some other purpose such as the small business incentives.

. The depreciation rate is 20 and the depreciation amount is 16000 in each of the five years. Diminishing Value Rate Prime Cost Rate Date of Application. 80000 365 365 200 5 32000 For subsequent years the base.

When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period here. On 01042017 Machinery purchased for Rs 1100000- and paid for transportation charge 150000- to install. This is the value.

Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. Hence a 20 diminishing value depreciation rate as we just explained.

ATO Depreciation Rates 2021 Table A. We already depreciated our car by 600 in the first year above. Diminishing value - depreciation Suggested Answer Jenny Do not put a Depreciation Ending Date.

However the temporary shortcut method is only available for period from 1 March 2020. Name Effective Life. Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now.

The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value. 10000 x 20 a 1600 deduction in your. Up to 8 cash back Enter an effective life of 8 years with Diminishing Value 150 the rate is 1875 and the annual depreciation for the first three years is.

Use the diminishing balance depreciation method to calculate depreciation expenses. Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its. Depreciation is applied at a fixed proportion to the book value of the asset according to the.

First year 24375 150. The recoverable cost is 4000 and you are using a 20 flat-rate. Rate Adjustments - Diminishing Value Depreciation Method Example.

Carpet has a 10-year effective life and you could calculate the diminishing value. It is not required since you are defining the Depreciation Method as. Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims.

This means the current value of our car is considered to be 2400 3000 600 2400. Cost value 10000 DV rate 30 3000. You place an asset in service in Year 1 Quarter 1.

You could claim a 2000 deduction in your first year ie. Example of Diminishing Balance Method of Depreciation. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

Depreciation rate finder and calculator You can use this tool to. This means there is no need to separately calculate the decline in value of these depreciating assets.

Choosing Depreciation Methods Diminishing Value Vs Prime Cost

Ato Tax Depreciation Methods Mcg Quantity Surveyors

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Formula Calculate Depreciation Expense

Written Down Value Method Of Depreciation Calculation

Double Declining Balance Depreciation Calculator

Depreciation Of Vehicles Atotaxrates Info

Depreciation Highbrow

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Which Depreciation Method Is Best For You The Real Estate Conversation

Mylaram Sreekaran Msreekaran Twitter

Straight Line Vs Reducing Balance Depreciation Youtube

How To Use The Excel Db Function Exceljet

Written Down Value Method Of Depreciation Calculation

Working From Home During Covid 19 Tax Deductions Guided Investor

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Diminishing Value Method Youtube